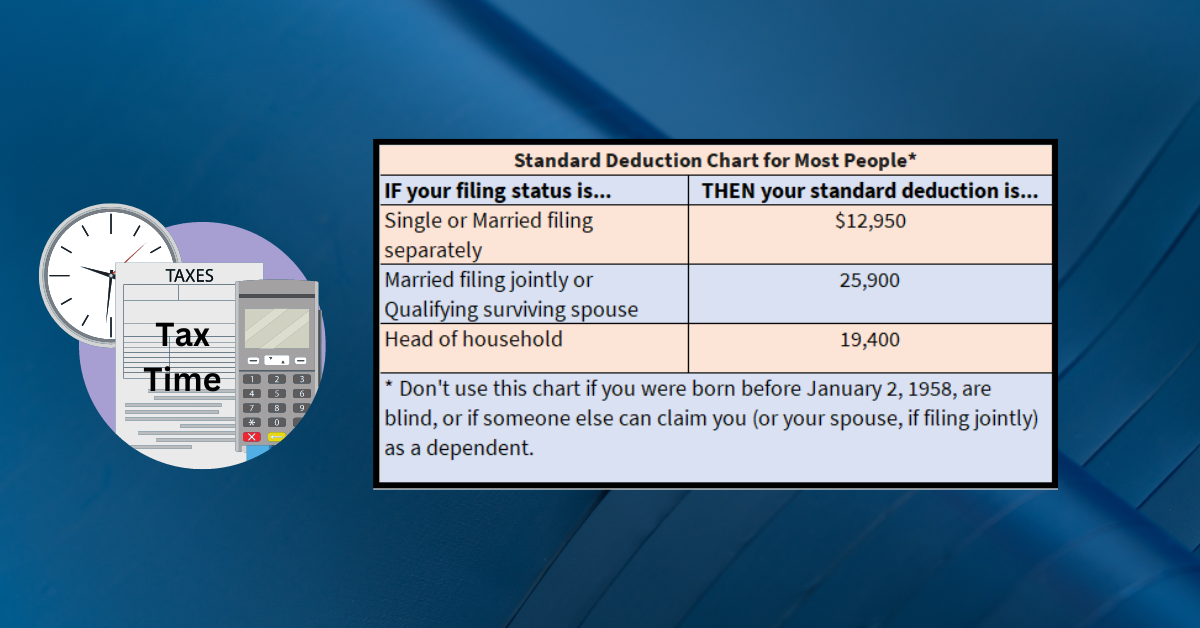

Standard Deduction 2022 Amount . the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. 2022 standard deduction amounts. The amount you can deduct depends on your filing status, age and whether you are blind. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The amount you can deduct. the irs updates the standard deduction amount each tax year to account for inflation. the irs updates the standard deduction amount each tax year to account for inflation. The standard deduction amounts will increase to $12,950 for individuals.

from marketstodayus.com

2022 standard deduction amounts. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The amount you can deduct. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the irs updates the standard deduction amount each tax year to account for inflation. The amount you can deduct depends on your filing status, age and whether you are blind. The standard deduction amounts will increase to $12,950 for individuals. the irs updates the standard deduction amount each tax year to account for inflation.

Understanding the Standard Deduction 2022 A Guide to Maximizing Your

Standard Deduction 2022 Amount the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The amount you can deduct depends on your filing status, age and whether you are blind. The standard deduction amounts will increase to $12,950 for individuals. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the irs updates the standard deduction amount each tax year to account for inflation. The amount you can deduct. the irs updates the standard deduction amount each tax year to account for inflation. 2022 standard deduction amounts. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was.

From www.pearsoncocpa.com

11 MMajor Tax Changes for 2022 Pearson & Co. CPAs Standard Deduction 2022 Amount the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The standard deduction amounts will increase to $12,950 for individuals. The amount you can deduct. 2022 standard deduction amounts. the standard deduction is a specific dollar amount that reduces the amount of income on which. Standard Deduction 2022 Amount.

From www.wsj.com

Standard Deduction 20212022 How Much Is It? WSJ Standard Deduction 2022 Amount The amount you can deduct. 2022 standard deduction amounts. the irs updates the standard deduction amount each tax year to account for inflation. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The amount you can deduct depends on your filing status, age and. Standard Deduction 2022 Amount.

From projectopenletter.com

2022 Federal Tax Brackets And Standard Deduction Printable Form Standard Deduction 2022 Amount 2022 standard deduction amounts. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The standard deduction amounts will increase to $12,950 for individuals. the irs. Standard Deduction 2022 Amount.

From news.2022.co.id

2022 Tax Brackets Standard Deduction Standard Deduction 2022 Amount 2022 standard deduction amounts. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The amount you can deduct depends on your filing status, age and whether. Standard Deduction 2022 Amount.

From www.taxuni.com

Standard Deduction 2022 Every Filing Status Standard Deduction 2022 Amount The amount you can deduct. The amount you can deduct depends on your filing status, age and whether you are blind. the irs updates the standard deduction amount each tax year to account for inflation. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. . Standard Deduction 2022 Amount.

From www.wsj.com

Standard Deduction 20222023 How Much Is It and Should I Take It? WSJ Standard Deduction 2022 Amount 2022 standard deduction amounts. The standard deduction amounts will increase to $12,950 for individuals. The amount you can deduct. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. the standard deduction is a specific dollar amount that reduces the amount of income on which. Standard Deduction 2022 Amount.

From 1800accountant.com

Standard Deduction for 20222023 Everything You Need to Know 1 Standard Deduction 2022 Amount The standard deduction amounts will increase to $12,950 for individuals. the irs updates the standard deduction amount each tax year to account for inflation. The amount you can deduct depends on your filing status, age and whether you are blind. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.. Standard Deduction 2022 Amount.

From www.youtube.com

Standard Deduction Example 2055 Tax Preparation 2022 2023 Standard Deduction 2022 Amount The standard deduction amounts will increase to $12,950 for individuals. 2022 standard deduction amounts. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. the irs updates the standard deduction amount each tax year to account for inflation. The amount you can deduct depends on. Standard Deduction 2022 Amount.

From exoddlvhb.blob.core.windows.net

Standard Deduction 2022 For 65 Years Old at William Wilson blog Standard Deduction 2022 Amount the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The amount you can deduct depends on your filing status, age and whether you are blind. 2022 standard deduction amounts. The amount you can deduct. the irs updates the standard deduction amount each tax year. Standard Deduction 2022 Amount.

From marketstodayus.com

Understanding the Standard Deduction 2022 A Guide to Maximizing Your Standard Deduction 2022 Amount the irs updates the standard deduction amount each tax year to account for inflation. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The amount you. Standard Deduction 2022 Amount.

From ironbridge360.com

Planning for 2022 The IRS has Increased Several Key Deductions Standard Deduction 2022 Amount the irs updates the standard deduction amount each tax year to account for inflation. the irs updates the standard deduction amount each tax year to account for inflation. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The standard deduction amounts will increase to. Standard Deduction 2022 Amount.

From www.kanakkupillai.com

Standard Deduction in tax 2022 Standard Deduction 2022 Amount The amount you can deduct depends on your filing status, age and whether you are blind. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The amount you can deduct. 2022 standard deduction amounts. The standard deduction amounts will increase to $12,950 for individuals. . Standard Deduction 2022 Amount.

From mint.intuit.com

What Are Tax Deductions and Credits? 20 Ways To Save Mint Standard Deduction 2022 Amount the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The amount you can deduct. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The standard deduction amounts will increase to $12,950 for individuals. the irs. Standard Deduction 2022 Amount.

From www.mysuncoast.com

IRS announces standard tax deduction increase for tax year 2022 to Standard Deduction 2022 Amount the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the irs updates the standard deduction amount each tax year to account for inflation. The amount you can deduct depends on your filing status, age and whether you are blind. 2022 standard deduction amounts. the standard deduction for. Standard Deduction 2022 Amount.

From projectopenletter.com

2022 Federal Tax Brackets And Standard Deduction Printable Form Standard Deduction 2022 Amount The amount you can deduct depends on your filing status, age and whether you are blind. 2022 standard deduction amounts. The standard deduction amounts will increase to $12,950 for individuals. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction for taxpayers who don't itemize their. Standard Deduction 2022 Amount.

From monieguide.com

Standard Deduction How Much It Is in 20222023 and When to Take It Standard Deduction 2022 Amount The amount you can deduct depends on your filing status, age and whether you are blind. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The amount. Standard Deduction 2022 Amount.

From summitviewadvisor.com

Planning for 2022 Key Deduction, Exemption, and Contribution Limits Standard Deduction 2022 Amount The amount you can deduct depends on your filing status, age and whether you are blind. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. 2022. Standard Deduction 2022 Amount.

From dxoigeees.blob.core.windows.net

Standard Deduction Chart For 2022 at Rafael Redfield blog Standard Deduction 2022 Amount the standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is higher for 2023 than it was. The standard deduction amounts will increase to $12,950 for individuals. the irs updates the standard deduction amount each tax year to account for inflation. 2022 standard deduction amounts. The amount you can deduct. The amount. Standard Deduction 2022 Amount.